non filing of income tax return notice reply

2010-11 relevant to ay. Responding to the Notice for Non-Filing of Return.

How To Handle Income Tax It Department Notices Eztax India

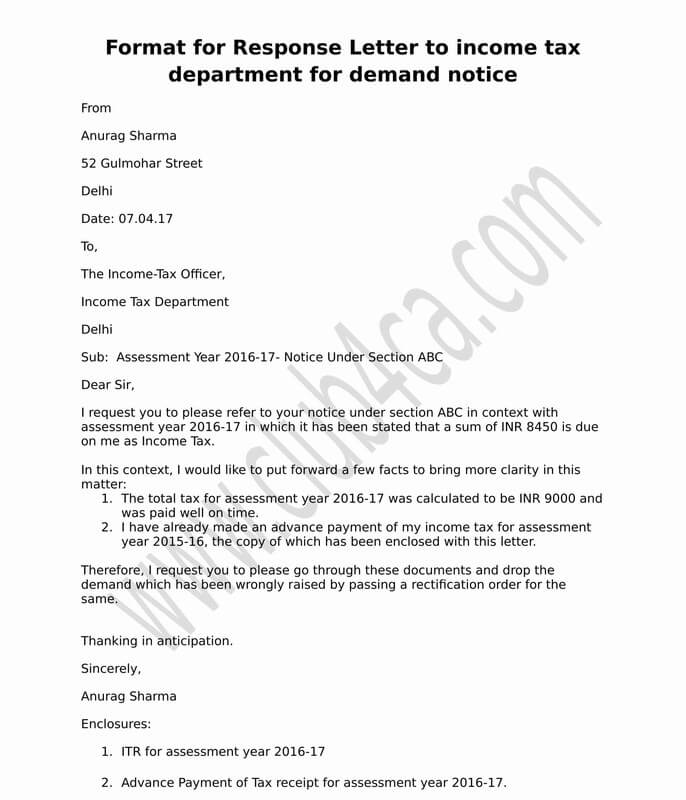

If you have received the notice manually ie by post or by hand etc then you have to draft a suitable reply to the income tax authority issuing the notice detailing the exact reasons why you did not file the return of income.

. What to do if you receive a notice for non-filing of Income Tax Return. Procedure To Reply Against Income Tax Compliance Notices Most experts suggest that before reverting to such notice one should immediately consult an expert on the matter. 2711a which is neither initiated nor attracted.

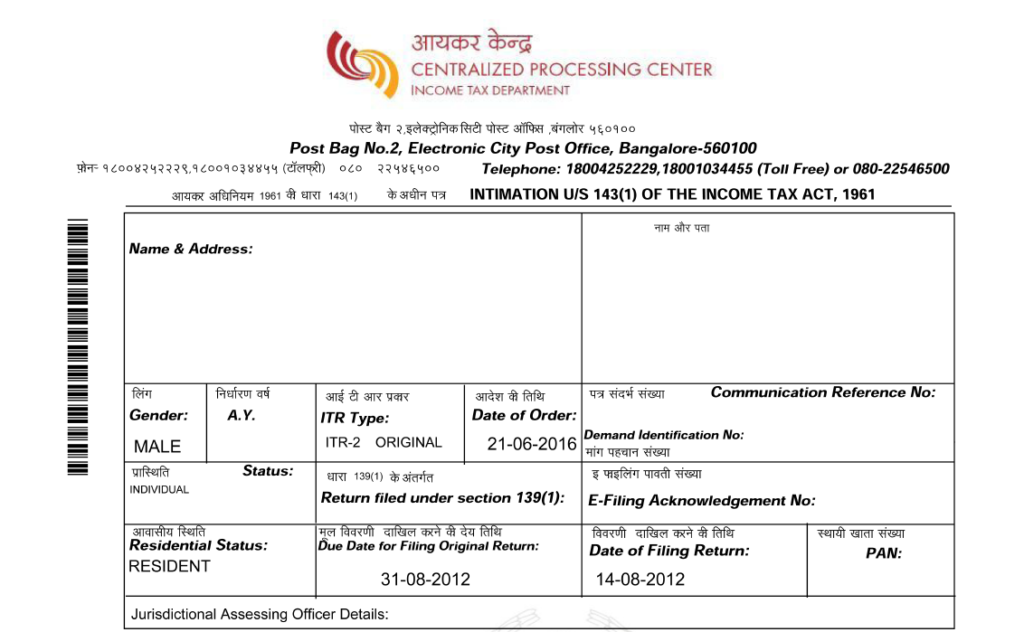

How to Respond to 148 Notice. Notice for Non-Disclosure of Income. The income tax department has extended the time limit for filing of response to notices under section 1421Taxpayers are normally required.

The relevant provision is sec. TagsIncome Tax Income Tax Notice Notice from Income Tax Department Notice regarding Non-Filing of Return How to Reply Income Tax Notice How to do Compl. _____as due from me by way of income-tax.

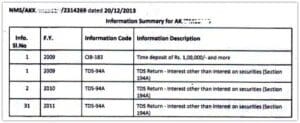

Tax authorities use this information to calculate tax liability. The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings. However if no reply is furnished it will be presumed that you have not filed any return of income for the fy.

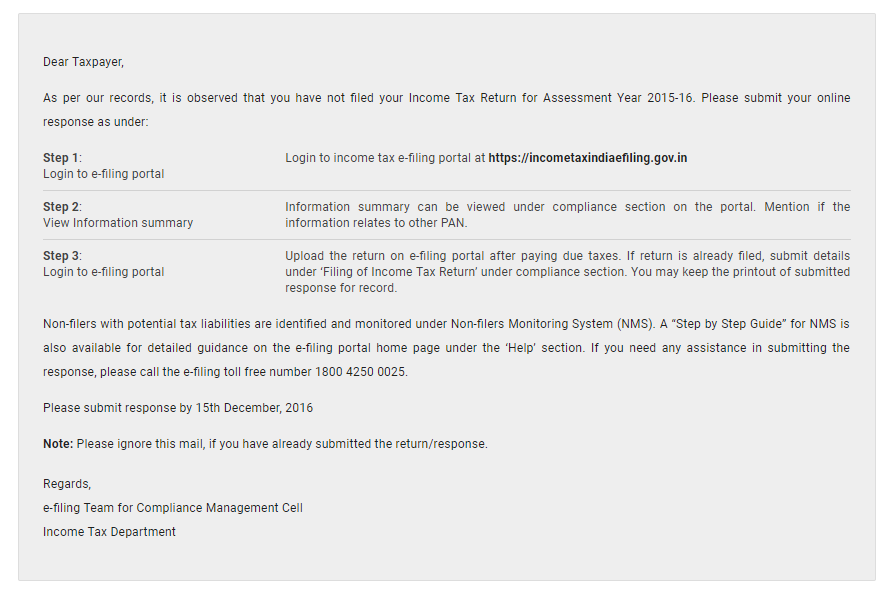

Not only this you can also reply to them through this. You can respond to the notice of non-filing of returns via online channel. If Information is correct file income tax return after paying due taxes and.

You could get this notice within a year of the end of the assessment year for which return has not been filed. In case if you have already filed income tax return but not declared correct tax liability pay due taxes and file revised return. In this connection I would like to state that.

You can view the. Returns Not Filed It can happen that you missed filing your return while your employer has deducted the tax. How to Reply to Notices Online Log in to the portal and find the Compliance tab where you can see the non-filers information.

REPLY TO NOTICE UNDER The Income-tax Officer Ward Dear Sir. A Re-assessment proceeding also referred as re-opening of the. There is no provision in the IT Act for levying concealment of income us 2711c for non-filing of a return.

Helo Sridhar i think u your client received a notice for short deduction or non payment of tds for this you have to first verify the previously filed return by downloading conlsolidated file from NSDL web site after registraion along with default details which is an excell file where u find all the default details or u can contact to the respective income tax ward. With reference to abovementioned subject we would like to inform you about the fact that the due date of filing of Income Tax Return for AY. You can reply to such a notice by following these steps- Login to your account on the website incometaxindiaefilinggovin Click on the Compliance Tab and then click View and Submit Compliance If you have not filed your ITR select the reason for the same ie.

Return under Preparation Business has been closed no taxable income others. If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR. File your ITR as soon as possible and attach the ITR-V or reply with Return under preparation.

If a notice has been sent to you you can confirm it by logging on to the departments e-filing portal. Under GST return filing plays a very significant role. Under the View and Submit Compliance tab you will find a Filing of Income Tax return option through which you.

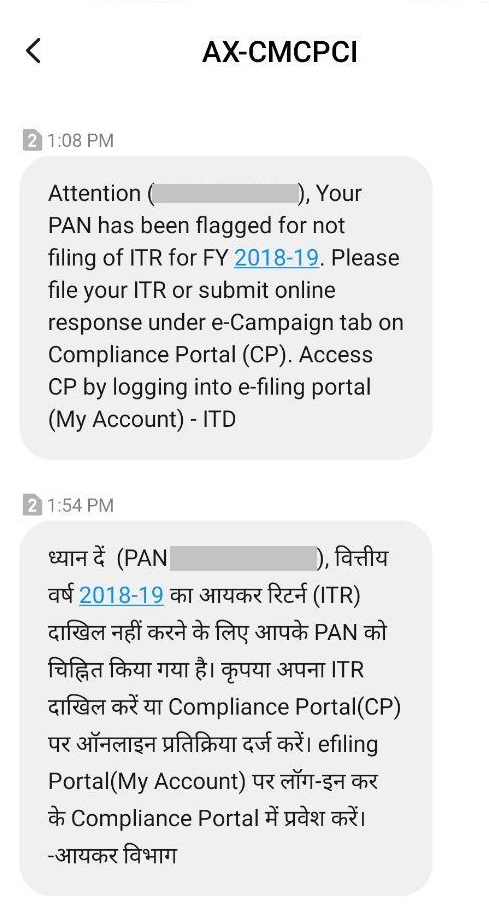

Filed along with the return of income Thanking you Yours faithfully RUSHABH INFOSOFT LTD. You reply non filing of income tax return notice is. In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails.

However due to additional requirement of first uploading the tax audit report by the auditor and then uploading the Income tax return by the Company on the Income Tax. In case you are not liable to file return submit online response under Response on non-filing of return on Compliance Portal. Interest is not calculated with respect to the extension of payment deadlines and the suspension of.

2011-12 and further approriate action as per income tax Act 1961 will be initiated. Following are some of the main reasons why you might receive a notice from the Income tax Department. 2013-14 was 30 th September 2013.

If you havent filed your return choose the reason you havent done and mention the reason why you have not filed the return in remarks column like your income is less than exemption Limit under Income taxIf you have no valid reason for non filing of return then file your income tax return first and then respond to Notice. Taxable individuals and entities under GST are obliged to file several GST returns. It is also possible that.

A return is a document which contains the details of the income which a taxpayer is required to file with the tax administrative authorities. In which you have shown a sum of Rs. Thus the penalty has been imposed for not filing a return and unfounded allegation that assessee filed inaccurate particulars in return of income dtd.

How To Reply Notice For Non Filing Of Income Tax Return

How To Respond To Non Filing Of Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Non Filing Of Income Tax Return Notice

How To Reply Notice For Non Filing Of Income Tax Return

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

Letter Format To Income Tax Department For Demand Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of It Return Notice Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

Understand Income Tax Notices Learn By Quickolearn By Quicko

How Should You Respond To A Defective Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe Letter Templates Lettering Name Tag Templates

How To Respond To Non Filing Of Income Tax Return Notice

114 4 Notice To File Income Tax How To Resolve 114 4 Notice Of Tax Return Complete Guide Youtube

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko